Insure Your Vehicle.

Disclaimer:

This article contains my personal views, opinions, and experiences only. It is provided for general educational and discussion purposes and is not intended as financial advice or as a recommendation for any specific person, product, or service.

Any cost figures, examples, or scenarios described are based solely on my own research and personal circumstances at the time I originally wrote this article. I have not verified whether they remain accurate, relevant, or up‑to‑date.

They are included only to illustrate my personal cost profile and to encourage readers — especially young drivers — to think about the total cost of vehicle ownership and the long‑term commitment that comes with buying a car.

This article does not take into account your individual objectives, financial situation, or needs. Before making any decision about vehicle purchase or insurance, you should do your own research, compare options, and consider seeking advice from a licensed financial adviser or insurance professional.

Laws, regulations, and insurance premiums can change over time and vary by location. All information is provided “as is” without any guarantee of completeness, accuracy, or timeliness.This article should be read in conjunction with the full Legal Disclaimer for this website, which applies to all content (static pages and blog articles) on this site.

Prepare Yourself By Insuring Your Vehicle

Car insurance is not just a routine formality but an essential safeguard, particularly for new drivers who are navigating the complex and often unpredictable world of driving. One of the primary reasons car insurance is crucial for new drivers is the peace of mind it offers.

As newcomers to the road, new drivers may lack the experience to handle every situation confidently. Knowing that they are covered by a comprehensive insurance policy helps alleviate some of the stress and anxiety associated with driving.

Another critical aspect to consider is the legal requirement. In many jurisdictions, car insurance is mandatory. Driving without the appropriate coverage can result in severe penalties, fines, and even the suspension of driving privileges. For new drivers, adhering to these legal requirements ensures that they remain compliant with the law and avoid unnecessary complications.

The financial protection car insurance provides is perhaps its most tangible benefit. New drivers are statistically more likely to be involved in accidents due to their inexperience. Repair costs, medical expenses, and potential legal fees can add up quickly, leading to financial strain. Comprehensive car insurance policies cover these expenses, offering young drivers a safety net that can prevent significant financial hardship.

Consider an 18-year-old who might have just received their driver’s license. One evening, while driving home from the gym, they collide with a parked car. Although they are not seriously injured, the damage to both vehicles is extensive. Fortunately, their comprehensive car insurance policy covers the repair costs, saving them from a major financial setback.

Without insurance, they would have faced thousands of dollars in repair bills, a significant burden for a young person just starting their journey into adulthood. In essence, comprehensive car insurance is a cornerstone for new drivers, combining peace of mind, legal compliance, and financial protection. These elements are crucial for ensuring that new drivers can traverse the roads with confidence and security, allowing them to focus on developing their driving skills without undue worry.

The Risks of Driving Without Insurance.

Driving without car insurance poses a multitude of significant risks, each carrying severe consequences. First and foremost, it is important to stress that adhering to insurance laws is not optional but a legal requirement in many regions around the world. Failing to comply with these laws can result in substantial penalties. Legal repercussions for uninsured drivers can range from hefty fines to suspension or revocation of their driver’s license, and in some cases, even incarceration.

Beyond the immediate legal ramifications, the financial burden of driving without insurance can be overwhelming. In the event of an accident, an uninsured driver is personally liable for all the damages and medical expenses incurred.

This means they must pay out-of-pocket for repairs to their vehicle, any property damage, and medical bills for any injuries sustained. These expenses can quickly accumulate to financially catastrophic levels, especially in serious accidents involving significant damages or injuries.

Long-term financial impacts also extend beyond the immediate costs associated with an uninsured accident. If an uninsured driver is sued and found liable, they may be subject to wage garnishment or liens on property, which can have lasting effects on their financial stability.

Furthermore, an uninsured driver’s future auto insurance premiums may skyrocket, as insurers view them as high-risk clients. This increase in premiums can strain future budgets, diminishing disposable income for years to come.

Moreover, the lack of insurance can affect one’s peace of mind and mental well-being. The constant worry about potential accidents, legal issues, and financial strain can create significant stress.

This underlines the importance of adhering to insurance laws and ensuring comprehensive car insurance coverage. Comprehensive car insurance not only aligns with legal requirements but also provides crucial financial protection and peace of mind for young drivers navigating the road.

Essential Coverage Options for Comprehensive Car Insurance.

When selecting comprehensive car insurance, young drivers must be aware of the critical coverage options available to them.

Understanding these options ensures that they are adequately protected against various risks associated with driving.

1. Liability Insurance: This is a fundamental component of any car insurance policy. It covers the costs associated with injuries to others and damage to their property if the policyholder is at fault in an accident. Given the inexperience of young drivers, having sufficient liability coverage is crucial to protect against potentially high costs of medical bills and repair expenses.

2. Collision Coverage: This insurance covers damages to the policyholder’s vehicle resulting from a collision, regardless of who is at fault. For young drivers, who may be more prone to accidents due to limited driving experience, collision coverage ensures that they can repair or replace their vehicle without incurring overwhelming expenses.

3. Comprehensive Coverage: Unlike collision coverage, comprehensive insurance extends protection to non-collision-related incidents, such as theft, vandalism, and natural disasters. This broader safety net is vital for young drivers as it protects their vehicle from a wide array of potential risks, ensuring peace of mind.

Uninsured/Underinsured Motorist Protection: This coverage is essential in cases where the at-fault driver lacks sufficient insurance.

It safeguards the policyholder by covering medical expenses and property damage that the at-fault driver cannot pay for.

Given the significant number of uninsured or underinsured drivers, this protection is crucial for young drivers.

By carefully considering these essential coverage options; liability insurance, collision coverage, comprehensive coverage, and uninsured motorist protection, young drivers can substantially enhance their financial protection and personal safety on the road.

Each type of insurance plays a pivotal role in mitigating diverse risks, ensuring a well-rounded approach to road security.

Recognizing the Financial Benefits of Proper Car Insurance.

Understanding the financial advantages of comprehensive car insurance is vital for young drivers. Proper insurance provides financial protection across various scenarios, preventing overwhelming expenses.

1. Coverage for Vehicle Repairs: Accidents, regardless of severity, often lead to vehicle damage. Repair costs can be significant, especially if extensive work is needed. Comprehensive car insurance typically covers these repair expenses, allowing young drivers to return to the road without financial strain. For example, instead of paying thousands for a damaged axle, insurance can cover the cost, saving substantial out-of-pocket expenses.

2. Medical Expense Coverage: Accidents can result in injuries requiring medical treatment, which can be costly. Comprehensive insurance often includes personal injury protection, covering medical bills for the driver and passengers. This ensures that necessary medical care is accessible without the burden of unaffordable bills.

3. Liability Protection: If a young driver is at fault in an accident, they could face lawsuits for damages and injuries caused to others. Legal fees and settlements can be prohibitively expensive. Comprehensive insurance includes liability coverage, protecting policyholders by covering these costs and safeguarding their financial stability.

Comprehensive car insurance offers a financial safety net, helping young drivers manage unexpected expenses related to repairs, medical bills, and liability effectively.

This underscores the importance of being adequately insured on the road.

Finding the Right Car Insurance Policy for Your Needs and Budget.

For young drivers, securing a car insurance policy that offers comprehensive coverage while remaining affordable can be challenging. However, with a strategic approach, you can find a policy that suits your needs and budget.

1. Compare Multiple Quotes: Begin by obtaining quotes from various insurance providers. Rates and coverage options can vary significantly between insurers. Utilize reliable comparison tools to view side-by-side evaluations of different policies. This process helps identify the best deal, considering not only the price but also coverage limits, exclusions, and added benefits.

2. Understand Rate Factors: Several factors influence car insurance rates for young drivers, including age, driving experience, vehicle type, and driving history. Young drivers are often seen as high-risk, leading to higher premiums. To mitigate this, consider driving a safer, less expensive vehicle, as these often come with lower insurance costs. Additionally, maintaining a clean driving record can positively impact your rates.

3. Explore Discounts: Many insurance companies offer discounts tailored to young drivers. These can include good student discounts, savings for completing driver’s education courses, or discounts for low-mileage driving. Bundling car insurance with other policies, like renters or homeowners insurance, can also result in savings. Always inquire about available discounts to reduce your premium.

4. Optimise Coverage Strategies: To keep costs down, consider opting for higher deductibles, which can lower your monthly premiums. Regularly review and update your policy to reflect changes in your driving habits or vehicle. Paying your premium annually instead of monthly can also lead to discounts from some insurers.

By comparing quotes, understanding rate factors, seeking discounts, and optimizing coverage strategies, young drivers can secure a car insurance policy that provides comprehensive protection without exceeding their budget. Regular policy reviews ensure that coverage continues to meet evolving needs and financial circumstances.

6.0 The Role of Safe Driving Practices in Reducing Insurance Premiums.

In addition to selecting the right insurance policy, young drivers can significantly influence their insurance costs through safe driving practices.

Insurance companies often reward drivers who demonstrate responsible behaviour behind the wheel with lower premiums.

Below are several key practices that can help young drivers maintain a clean driving record and reduce their insurance costs:

1. Obey Traffic Laws: Adhering to speed limits, traffic signals, and other road regulations is fundamental to safe driving. Avoiding traffic violations not only enhances safety but also helps maintain a clean driving record, which is a crucial factor in determining insurance rates.

2. Avoid Distractions: Distracted driving is a leading cause of accidents, particularly among young drivers. Staying focused on the road by avoiding mobile phone use, eating, or engaging in other distractions can significantly reduce the likelihood of accidents.

3. Complete Defensive Driving Courses: Many insurance providers offer discounts to drivers who complete defensive driving courses. These courses teach valuable skills for anticipating and reacting to potential hazards on the road, ultimately making drivers safer and more aware.

4. Maintain Your Vehicle: Regular maintenance of the vehicle ensures that it operates safely and efficiently. Keeping tires properly inflated, brakes in good condition, and lights functioning can prevent accidents caused by mechanical failure, which can also lead to insurance claims.

5. Limit Night time Driving: Statistics show that driving at night increases the risk of accidents due to reduced visibility and increased likelihood of encountering impaired drivers. Whenever possible, young drivers should limit their driving during late-night hours.

6. Utilize Telematics Programs: Some insurance companies offer telematics programs that track driving behaviour through a mobile app or device installed in the car. Safe driving habits, such as smooth acceleration and braking, can lead to discounts based on real-time driving data.

By adopting these safe driving practices, young drivers not only enhance their safety on the road but also position themselves to benefit from lower insurance premiums. This proactive approach underscores the importance of responsible driving behavior as a means to manage insurance costs effectively while ensuring personal safety and compliance with legal requirements.

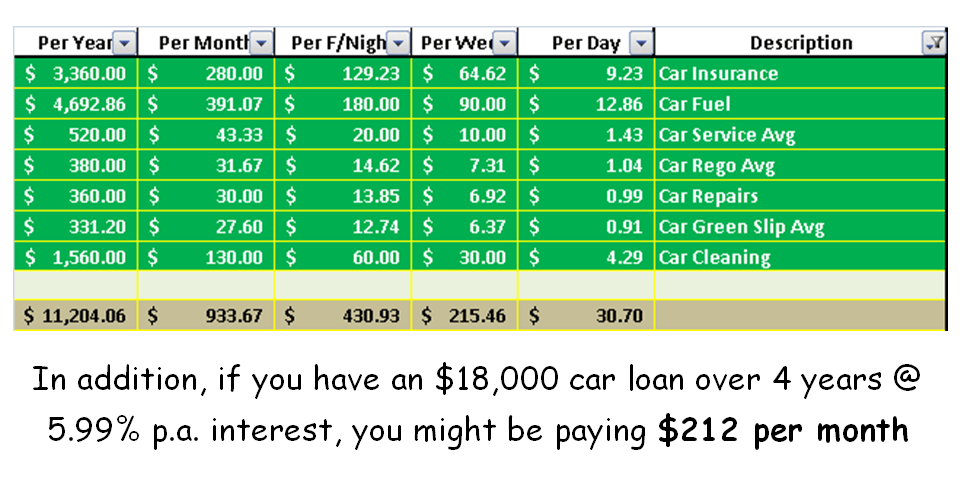

Example Of The Costs Associated With Insurance & Other Ongoing Costs

Being a young person with a car

is sometimes very difficult financially.

It’s a period in your life when you are making the least amount of money

you will ever make but the costs for you

to exist are ridiculously expensive.

There is no getting around the fact that you must very honestly work out

your true monthly costs.

Force yourself to be brutally honest with the fixed costs you have every

month.

Once you truly understand the fixed costs you are facing each and every

month, you can then determine if there’s any wriggle room for entertainment.

It might be that in order to keep a roof over your head and be insured,

you might have to stop spending around $15 per day on iced almond milk lattes.

Who knows, you might also have to think of some good excuses to avoid

going to the pub after work with you mates on Friday afternoons and spending $8

on a beverage you can have at home for roughly $2.

If you have taken the plunge and moved out of your family home, you will

most likely be paying rent.

As if rent wasn’t enough, then you need to pay for power and water,

groceries to survive and then of course, there is the small matter of buying a

car and then all the ongoing costs that come with it.

You really need to be anchored in your expectations about what type of

car you actually need rather than what you occasionally think

you might need.

You will need to devote a significant amount of time to researching all the vehicle related costs you might be up for. This will help you determine what type of car you can afford. Once you’ve developed a budget and know the maximum vehicle related costs you can afford, before increasing your existing financial pressure, you need to stick to it.

Comprehensive Car Insurance for a 19yr old.

In my opinion, one of the most unfair costs for those under the age of 25 is the high cost of comprehensive motor vehicle insurance.

Insurance companies, seemingly, prefer to paint all young people with the same brush, regardless of how responsible, well-behaved, educated, or mature the young individual is.

To learn some exactness of how bad the problem is, I did a lot of online research and in readiness, I wrote down the following criteria to be used, not knowing what I might be asked:

1. I’m a 19-year-old male.

2. I work part-time and have a perfect driving record.

3. I got my drivers licence age 17.

4. I’m seeking comprehensive vehicle insurance.

5. I used a couple of different Make/Model combinations.

6. Only used the year 2017.

7. Estimated worth of $18,000.

8. 4cyl petrol engine with a 6 speed automatic gearbox.

9. 5 door hatchback.

10. No finance owing.

11. No modifications of any type have been made to the vehicle

12. The car is in very good condition.

13. I require excess free windscreen cover & roadside assistance

14. Hopefully no more than $500 excess.

15. I drive the car around 15,000 km per year.

Using all this information, the cheapest I can find was $260 per month.

The other thing that came to mind was how a lot of people believe that having your first car in your parents’ name is preferable. In this scenario, the child gives the parents the money and the car is purchased in the parent’s name. The car would also be registered and have compulsory third party and comprehensive insurance in the parents name.

The parents then need to stipulate that the child drives the car on a regular basis, more than 24 times per year I think it was.

I’m not so sure that option is any better to be honest and here’s what I discovered online.

For all of the same information, a 55-year-old male parent who will have one 19-year-old male driving the car more than twice a month will pay $279, so there is hardly any savings to be enjoyed from trying to abuse the system anyway.

I dare say that the insurance companies became very aware about this type of behaviour a long time ago. You are far better off to answer the questions correctly and honestly and just shop around using the truth only.

After all, if you were to be dishonest with answering the questions and then an accident or theft occurs, the truth will eventually be revealed, and you could find yourself in a lot of financial and possibly legal trouble.

As it turns out there is a massive difference in costs when you compare comprehensive vehicle insurance between 19 & 55 year old males in Australia.

Using all the same vehicle and driving specifications used for the 19 yr old I did some considerable research.

The cheapest deal I could find for a 55yr old male to have comprehensive insurance for the same specs, with no younger people driving the car as well as excess free windscreen and roadside assistance, was $97 per month, thus the 19 yr old will pay nearly 3 times more than a 55yr old.

Finally, I wanted to see if the costs situation changed significantly for comprehensive vehicle insurance for a 19yr old using a very different vehicle.

I used a few different Make/Model combinations for 2014, 4cyl turbo diesel, fuel injected, 5 speed manual gearbox long wheel base Van.

It had no finance owing, was in very good condition and was to be used for both private and business purposes. I used that is was worth $20, 000 and that I drove 20,000 km per year as the driving average.

Other information I used was that I parked under carport at night and on the street during the day.

The cheapest I could find for a 19 year old male was $270 per month.

Anyway you slice it, that’s a fair chunk of change for a 19yr old, just to insure the vehicle that they need for work every month.

Is there an alternative to comprehensive Insurance?

Third Party Property Damage

Depending on the age and type of vehicle you’re insuring, you could be better off restricting your coverage to Third Party Property Damage (TPPD), which will cover any damage you cause to other people’s vehicles or property when you are at fault.

For a 19-year-old male, the cheapest monthly cost I could find for TPPD with roadside assistance, using the 1st set of vehicle data was $66.10 per month. In this case, if your vehicle is damaged, stolen, or destroyed in an accident, you are responsible for all expenditures, not the insurance provider.

Third Party Fire & Theft

Using the 1st set of vehicle data, for a 19yr old male to have Fire & Theft Insurance with roadside assistance but with $695 excess and they would only insure up to $10,000, up to $5,000 damage caused by another driver, the cheapest I could find was $53 per month.

What are my thoughts on all of this?

If you are under the age of 25, have a job, and rely on your vehicle to make a living, I believe you should get comprehensive insurance and be sure to either tick the extra box for roadside assistance or make sure you get it separately.

With compulsory third party insurance (CTP) mandated in all Australian states, I’m not sure I see the need for Third Party Property Damage. If you cannot afford Comprehensive Insurance and your vehicle is worth less than $10,000, Third Party Fire & Theft may be a viable option but please do your own research.

Contact Us